Selling the Bonds at a Premium Has the Effect of

B attracting investors that are willing to pay a lower rate of interest than on similar bonds. This is the attraction to premium bond pricing and rates.

Causing the total cost of borrowing to be lower than the bond interest paid c.

. Selling the bonds at a premium has the effect of. A person would buy a bond at a premium pay more than its maturity value because the bonds stated interest rate and therefore the bonds interest payments will be greater than those expected by the current bond market. Raising the effective interest rate above the stated interest rate.

Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. The coupon rate of interest is 10 and has a market rate of interest at the rate of 8. Selling the bonds at a premium has the effect of raising the effective interest rate above the stated interest rate attracting investors that are willing to pay a lower rate of interest than on similar bonds causing the interest expense to be higher than the bond interest paid causing the interest expense to be lower than the.

Bond transactions affect various financial statements from income statements and balance sheets to statements of cash flows and shareholders equity reports. If there was a premium on bonds payable then the entry is a debit to premium on bonds payable and a credit to interest expense. If you buy a bond at a premium -- meaning you pay more than the face amount -- you incur a loss of the amount of premium paid when the.

This is a discounted bond meaning an investor would pay less for the same yield making it a better option. But investors who sell a bond before it matures may get a far different amount. Causing the contract interest rate to be lower than the market interest rate.

Broader market conditions can have an impact on bonds. The maturity period of the bond is 10 years and the face value is 20000. This is because investors want a.

Example of Premium Bond Amortization. Selling the bonds at a premium has the effect of. If market interest rates rise to 4 in.

Interest rates are rising in 2022 here are your best money moves. Causing the total cost of borrowing to be higher than the bond interest paid b. Market conditions the age of a bond and its rating.

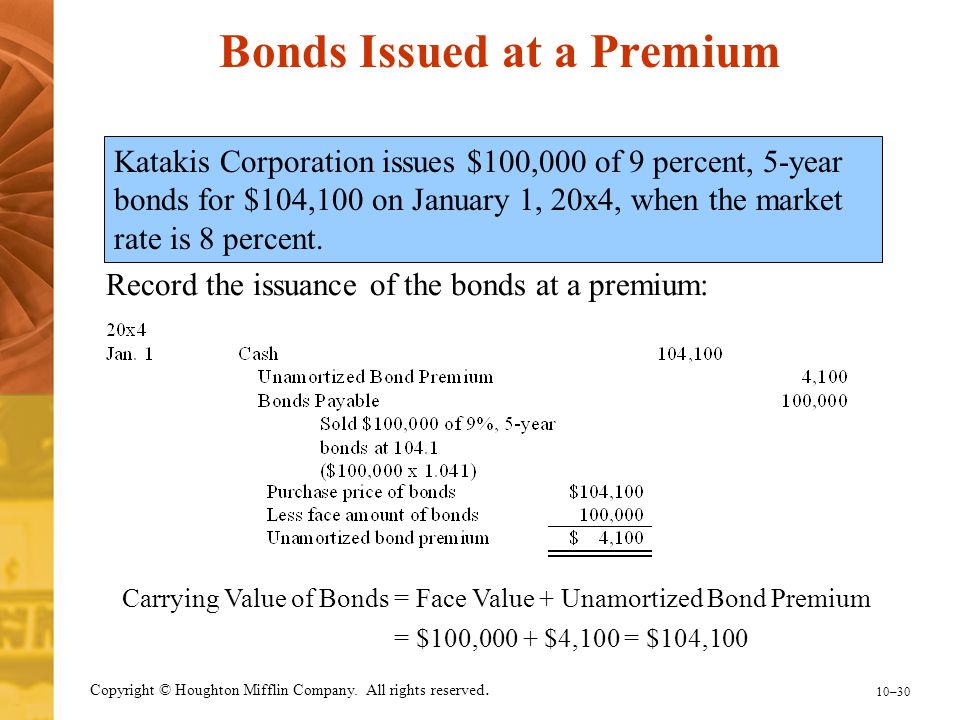

Example of a Bond Premium. Bonds issued at a Premium. Causing the interest expense to be lower than.

Attracting investors that are willing to pay a lower rate of interest than on similar bonds c. Causing the total cost of borrowing to be higher than the bond interest paid. Let us consider an investor that purchased a bond for 20500.

Factors that influence the performance of bonds. It is also possible that a bond investor will have no choice. Page 1 of 4 Question 1 125 points Saved Selling the bonds at a premium has the effect of Question 1 options.

In return the issuer promises to pay you a specified rate of interest during the. Apart from interest rate movements there are three other key factors that can affect the performance of a bond. A premium bond is a bond trading above its par value.

A bond is a debt security similar to an IOU. Causing the total cost of borrowing to be lower than the bond interest paid. Market conditions the age of a bond and its rating.

Still premium bonds with higher pricing and a lower rate might earn more if the market rate is lower than the bond rate. Ascend Investment Partners Grand Cayman CA. Lets look at each in turn.

The company receives cash more than the bond par value. If a bond is trading at a premium this simply means it is selling for more than its face. Raising the effective interest rate above the state interest rate d.

When you buy a bond you are lending to the issuer which may be a government municipality or corporation. Raising the effective interest rate above the stated interest rate. Causing the effective interest rate above the stated interest rate.

Lets look at each in turn. A bond trades at a premium when it offers a coupon rate higher than prevailing interest rates. A raising the effective interest rate above the stated interest rate.

C causing the total cost of borrowing to be higher than the bond. Attracting investors who desire to purchase bonds which are of higher quality. For example if interest rates have risen since the bond was purchased the bondholder may have to sell at a discountbelow par.

A bond is a debt product a company sells to investors -- such as investment banks rich people and pension funds -- privately or on public exchanges also known as debt markets. This has the effect of reducing the overall interest expense recorded by the issuer. Factors that influence the performance of bonds.

For example lets say you have a 10-year 1000 bond paying a 3 coupon. But if interest rates have fallen the bondholder may be able to sell at a premium above par. Causing the interest expense to be lower than the bond interest paid.

In a simplified example if you buy a five-year bond with a 6 coupon at a price of 105 and amortize one point of premium a year for the five years then each year you can deduct 10 of the 60. Group of answer choices. The periodic amortization of bond issuance costs is recorded as a debit to financing expenses and a credit to the other assets account.

Broader market conditions can have an impact on bonds. Selling bonds at a premium has the effect of. For example if the investor wants.

Increasing the amount of cash paid for interest each 6 months. If you want to sell your bond before it. It happens as the bond coupon rate is higher than market rate so investors will pay premium to enjoy higher return.

Causing the interest expense to be higher than the bond interest paid d. Bonds issued at premium means the company sell bond at a price that is higher than par value. Attracting investors that are willing to pay a lower rate of interest than.

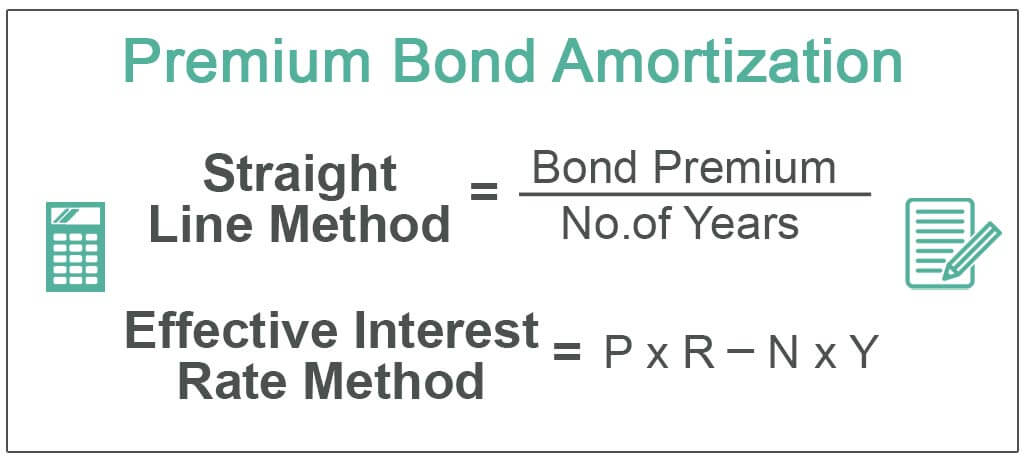

Let us calculate the amortization for the first second and third period based. When bond interest rates increase prices go down. Selling the bonds at a premium has the effect of a.

Increasing the amount of cash paid for interest each 6 months. Raising the effective interest rate above the stated interest rate b. Apart from interest rate movements there are three other key factors that can affect the performance of a bond.

Selling the bonds at a premium has the effect of a.

Bond Premium With Straight Line Amortization Accountingcoach

Amortizing Bond Premium Using The Effective Interest Rate Method Accountingcoach

Amortization Of Bond Premium Step By Step Calculation With Examples

Long Term Liabilities Skyline College Lecture Notes Ppt Video Online Download

No comments for "Selling the Bonds at a Premium Has the Effect of"

Post a Comment